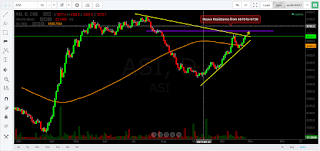

ASI no doubt tried to move towards the heavy resistant area coming from the previous rally. But stalled short of the 13th October high of 6648 points. Fridays close was lower than the previous day. The high of Thursday was higher than Friday's making a lower high in the daily candle. This is however happened within the present uptrend with higher lows, that started from early September. Therefore we need to bow down to this up-trend until we see a failure below 6346 points, which happened to be the trend reversal that occurred during the start of the trend. As shown in the chart the market is sitting within a trend line drawn by connecting lower highs, and another line connecting the higher lows, which is a typical symmetrical triangle, that happens when the market is wanting to find a direction. As we are at the tip of the 2 trend lines the massage is clear. Any thing could happen either to break out of the top line or the bottom. Therefore having long positions to trade may not be the best, until a trend continuation is confirmed by breaking out of the upper trend line. Stock specific trading strategies would be more preferred than trading stocks based on the ASI.

Making money in the Stock Market is not easy, but not hard only with increased education and understanding.......

Sunday, October 29, 2017

Thursday, October 26, 2017

ASI Today - 26.10.2017. Blue Chips ruled the day

Turnover was LKR 1.17B. Mainly from the blue chips. The retailers too had their say in some of the counters. SAMP was the biggest performer having a T/O of LKR 240.8M, entirely in the Normal board. CCS,HHL,HNB,JKH and LLUB helped to beef up the T/O. Whilst the retailers commanded the speed in counters like BFN,TFC.X,JINS and SIRA with higher trading numbers. All in all there were 5143 trades.

It was a good day as many counters, large counters in particular kept the market alive. Expect this momentum to persist tomorrow too, as the demand for the Banks and some blue chip counters are still intact.

ASI edged over the top yellow trend line I was showing you yesterday. It is now trying to test 76.40% fib ret line at 6670 points which is only 40 points away as the ASI closed the at 6633 points.

Main catalyst for the market to be buoyant will be the quarterly announcements and the bullish international markets. Some are pinning hopes on a positive business friendly budget in November as well. As such there is a confluence of many positive developments as against the negatives.

Surpassing 6670 points will open up the index to face the strong resistance coming from the top end of the previous rally. That is something that we need to watch now. If the market is going to pierce through that channel of resistance then the BANKS must perform very strongly. Let's hope for the best.

It was a good day as many counters, large counters in particular kept the market alive. Expect this momentum to persist tomorrow too, as the demand for the Banks and some blue chip counters are still intact.

ASI edged over the top yellow trend line I was showing you yesterday. It is now trying to test 76.40% fib ret line at 6670 points which is only 40 points away as the ASI closed the at 6633 points.

Main catalyst for the market to be buoyant will be the quarterly announcements and the bullish international markets. Some are pinning hopes on a positive business friendly budget in November as well. As such there is a confluence of many positive developments as against the negatives.

Surpassing 6670 points will open up the index to face the strong resistance coming from the top end of the previous rally. That is something that we need to watch now. If the market is going to pierce through that channel of resistance then the BANKS must perform very strongly. Let's hope for the best.

Wednesday, October 25, 2017

ASI today - 25.10.2017. Retailers showed robust activity

ASI mainly belonged to the retailers today. If you happen to be one such retailer, ask yourself, as to why you were wondering when many of your type are out in the field.

BFN, ACL, MAL, SAMP, MASK, GSF, CFVF, and VPEL were the stocks that they could participate quite liberally. Alongside there were Investors who picked up Stocks such as SAMP by paying premiums, showing the confidence behind the Stock.

Total T/O was LKR 892M+, out of which 38% was through crossings, whilst 62% came from the Normal Board activities. We witnessed 5946 transactions. Up over the last couple of days.

Some of the blue chips are waning out in the likes of JKH. But there was a block trade on it. Hopefully a foreign buy. Banks hit another round of a Trend continuation, after a slight consolidation. Plantations are not that attractive, which is understandable after a non stop trend extension. However there is steam in it until the results are announced.

ASI is testing a critical area of resistance between 6610 and 6620, as it closed at 6615 points, with an intra-day high of 6622 points. We need to see a strong breakout from this area. Possibly it would be the banks and some not so regular blue chips such as BUKI helping to do so. Watch it.

BFN, ACL, MAL, SAMP, MASK, GSF, CFVF, and VPEL were the stocks that they could participate quite liberally. Alongside there were Investors who picked up Stocks such as SAMP by paying premiums, showing the confidence behind the Stock.

Total T/O was LKR 892M+, out of which 38% was through crossings, whilst 62% came from the Normal Board activities. We witnessed 5946 transactions. Up over the last couple of days.

Some of the blue chips are waning out in the likes of JKH. But there was a block trade on it. Hopefully a foreign buy. Banks hit another round of a Trend continuation, after a slight consolidation. Plantations are not that attractive, which is understandable after a non stop trend extension. However there is steam in it until the results are announced.

ASI is testing a critical area of resistance between 6610 and 6620, as it closed at 6615 points, with an intra-day high of 6622 points. We need to see a strong breakout from this area. Possibly it would be the banks and some not so regular blue chips such as BUKI helping to do so. Watch it.

Tuesday, October 24, 2017

ASI Today - 24.10.2017. ASCOT bought over by Foreign/Local Investors

Some lucky Traders capitalized on the ASCOT deal as it went up from 32 to 44.50 during intra-day trading. This was due to a group of Investors both Local and Foreign bought more than 44% upto a high of 42.50. When the 1st block crossed at 42/- it was trading at 33.00 in the normal board. This made the traders to JUMP AND BUY from the sellers. The lucky traders managed to grab roughly about 50K of shares below 38.00. They were the most benefited. A Mandatory Offer will be made at 42.50 as the Investors have exceeded 30% trigger.

More than LKR 250M worth of T/O came from ASCO, whilst the Balance LKR 490M, were shared among others, in a total T/O of LKR 743M+.

Another stage of the Plantations rally is on, and would exist till the Sept results are out. Yet this sector is highly volatile, which is famous for versatile surprises. Hence caution is the best medicine.

A further 17 points were added to the ASI today, and it stood at 6588 points in the end of trading.

Market was a bit busy today than yesterday, but has a long way to go.

There is a resistance around 6600 points to 6620 points. Need to see whether it will be respected.

More than LKR 250M worth of T/O came from ASCO, whilst the Balance LKR 490M, were shared among others, in a total T/O of LKR 743M+.

Another stage of the Plantations rally is on, and would exist till the Sept results are out. Yet this sector is highly volatile, which is famous for versatile surprises. Hence caution is the best medicine.

A further 17 points were added to the ASI today, and it stood at 6588 points in the end of trading.

Market was a bit busy today than yesterday, but has a long way to go.

There is a resistance around 6600 points to 6620 points. Need to see whether it will be respected.

Monday, October 23, 2017

ASI Today - Billion Rupee T/O, but mediocre activity

More than 500M came from 2 block trades in Sampath and Softlogic Holdings. Central Finance had a lot of attention today with more than a million shares trading, bringing in 120M+ in T/O.

The rest of the Market did not make any surprises, with the Index closing lower by 2 points. Plantations did a slight come back, after a few days of side way movement.

The ASI is still around 6570 points, with a side way consolidation. Eventhough the overall market is hanging in the balance there are opportunities for the active well planned traders. Whilst there is value to pick for the Investors too.

The rest of the Market did not make any surprises, with the Index closing lower by 2 points. Plantations did a slight come back, after a few days of side way movement.

The ASI is still around 6570 points, with a side way consolidation. Eventhough the overall market is hanging in the balance there are opportunities for the active well planned traders. Whilst there is value to pick for the Investors too.

Friday, October 20, 2017

ASI Today - 20.10.2017

Today's highlight was Chevron Lanka plc. This stock got hit so badly for many a month. Onslaught on the share was understandable, as their Market share and the Profits Dropped. Things got better in September. Their profits were better than the June quarter, and the dividend was slightly better than that of July. Investors rushed in to celebrate, and took it up to a slightly higher level. What closed yesterday at 112.70, closed at 118.50 today. Volume was also commendable.

There were many interesting stuff that happened in the Market besides Chevron, Sampath was traded for the last day before going XR on Monday. There were many collectors on that due to the arbitrage profit you could get. The busiest in the Plantation Co's was LDEV with more than 338k was changed hands.

T/O was lower at 568M. SL20 Stocks did not bring any surprises, hence it was business as usual.

ASI picked up thanks to Chevron increased by 17+ points. The 50% Fib ret of 6558 held, that is positive.

As shown in LLUB and VFIN, the market is positively responding to increased profits and growth in the quarterlies, which can keep the ASI busy in the coming weeks.

There were many interesting stuff that happened in the Market besides Chevron, Sampath was traded for the last day before going XR on Monday. There were many collectors on that due to the arbitrage profit you could get. The busiest in the Plantation Co's was LDEV with more than 338k was changed hands.

T/O was lower at 568M. SL20 Stocks did not bring any surprises, hence it was business as usual.

ASI picked up thanks to Chevron increased by 17+ points. The 50% Fib ret of 6558 held, that is positive.

As shown in LLUB and VFIN, the market is positively responding to increased profits and growth in the quarterlies, which can keep the ASI busy in the coming weeks.

Thursday, October 19, 2017

ASI Today - 19.10.2017

Turnover was over a Billion at 1070 M. That was significant as 725M were from the normal board, whilst 345M came from Crossings. JKH, NDB,SAMP and LLUB saw 553M worth of Turnover, making the bulk of the contribution. A special attention was given to TESS today with more than 7.5M shares trading among 412 trades. LLUB was the highest Traded with 500+ transactions, and 91M in T/O.

Overall the Market wasn't that active, but saw traders going about accumulating many Stocks in Plantations, Finance and Manufacturing sectors. Nothing out of the ordinary was witnessed except in TESS. Better watch that out as the volume traded was significant to ignore.

ASI has now come back to the 50% Fib retracement area that I plot at 6555 points. That is a critical support level. However it will be interesting to see whether it will hold above 61.8% fib ret at 6508 points.

There is no sign of a momentum build up yet in the ASI, which is closely watched.

Overall the Market wasn't that active, but saw traders going about accumulating many Stocks in Plantations, Finance and Manufacturing sectors. Nothing out of the ordinary was witnessed except in TESS. Better watch that out as the volume traded was significant to ignore.

ASI has now come back to the 50% Fib retracement area that I plot at 6555 points. That is a critical support level. However it will be interesting to see whether it will hold above 61.8% fib ret at 6508 points.

There is no sign of a momentum build up yet in the ASI, which is closely watched.

Tuesday, October 17, 2017

ASI Today - 17.10.2017

Market looked big today with 3 big crossings. Largest being the sale of the controlling stake of EAST, which was 63.91% or 88,345,235 shares of the Company. This deal brought in a T/O of 1095.5 M Rupees. The next 2 being COMB and CCS, adding another 488.9 M Rupees. The rest of the market chipped in with a T/O of 308.8 M.

The ASI shed another 23.89 points. It has now shed 76 points from it's swing high of 6648 points. The ASI rested nicely on the 100 sma today. But may not be for long. However 100sma is an important worm to look at.

Traders still have room to get busy on plantations, and expected growth stories on a few other counters. We witnessed robust collection on those counters.

Needless to mention the stocks that have gathered in steam at present as I have shared them in my previous post captioned " Stocks that are gathering momentum", will reward you, if you are bold enough to dabble in them.

It is highly advisable to accumulate the counters that can show growth, which are in plenty these days. Particularly when the market is in a pullback. That will be the only time you could do so.

The CSE will be on holiday tomorrow O/A Deepavali Festival.

The ASI shed another 23.89 points. It has now shed 76 points from it's swing high of 6648 points. The ASI rested nicely on the 100 sma today. But may not be for long. However 100sma is an important worm to look at.

Traders still have room to get busy on plantations, and expected growth stories on a few other counters. We witnessed robust collection on those counters.

Needless to mention the stocks that have gathered in steam at present as I have shared them in my previous post captioned " Stocks that are gathering momentum", will reward you, if you are bold enough to dabble in them.

It is highly advisable to accumulate the counters that can show growth, which are in plenty these days. Particularly when the market is in a pullback. That will be the only time you could do so.

The CSE will be on holiday tomorrow O/A Deepavali Festival.

Monday, October 16, 2017

Stocks that are gathering in momentum

Following stocks appears to be gathering momentum

CFVF - there is a strong support base forming between 38.50 and 39.00. If you have it keep an eye on. If you want to enter, try at the lower end of the channel i.e. 38.50.

RICH - A considerable volume traded at 14.00, as such the support now is between 13.50 and 14.00, but more biased towards 14.00.

SAMP - 340 has a good short term support, and the next support is around 338.50. The trend would resume it's ascent once the support is made very strong.

MBSL - Fair volume traded today mainly above 15.00. Presently the price is trying to breakout over 15.40, and with the present momentum build up we will see newer highs in the short term.

LDEV - strong accumulation at 13.50 and 13.60. Once the consolidation is complete this could test new highs.

MAL - 11.50 to 11.70 is where the support is. Accumulation will have to be at this range. Trend will continue once the accumulation is over.

MHDL - 2.12 million shares traded between 11 and 13.90 a few days ago. this has helped the stock to trade at the upper range of this channel. No signs of a trend continuation yet. Watch to collect low or wait for a higher close.

CFVF - there is a strong support base forming between 38.50 and 39.00. If you have it keep an eye on. If you want to enter, try at the lower end of the channel i.e. 38.50.

RICH - A considerable volume traded at 14.00, as such the support now is between 13.50 and 14.00, but more biased towards 14.00.

SAMP - 340 has a good short term support, and the next support is around 338.50. The trend would resume it's ascent once the support is made very strong.

MBSL - Fair volume traded today mainly above 15.00. Presently the price is trying to breakout over 15.40, and with the present momentum build up we will see newer highs in the short term.

LDEV - strong accumulation at 13.50 and 13.60. Once the consolidation is complete this could test new highs.

MAL - 11.50 to 11.70 is where the support is. Accumulation will have to be at this range. Trend will continue once the accumulation is over.

MHDL - 2.12 million shares traded between 11 and 13.90 a few days ago. this has helped the stock to trade at the upper range of this channel. No signs of a trend continuation yet. Watch to collect low or wait for a higher close.

ASI Today - 16.10.2017

ASI took a breather. As I expected the Banking index pulled Back. That was nothing extra-ordinary. All 3 big banks rallied non-stop, hence a cooling off. With the Banks pulling back the momentum of the Plantation Companies saw another day of consolidation. This sector too needed this break. My charts tell me that this is a healthy development.(Remember your chart is yours, and mine's mine. Better get that Straight)

T/O as well as Trades decreased. The most noticeable counters that ended positively were RICH and DIAL. Both had active trading. Expect the momentum to build up on RICH in particular, whilst DIAL needs to be seen.

Amidst the pullback Counters that were actively traded in the Banking and Plantation Sectors, will get busy once again. Simply because of positive quarterly results. Don't ignore and be upset when they are falling. Keep collecting, as the Short Term returns look promising for them.

T/O as well as Trades decreased. The most noticeable counters that ended positively were RICH and DIAL. Both had active trading. Expect the momentum to build up on RICH in particular, whilst DIAL needs to be seen.

Amidst the pullback Counters that were actively traded in the Banking and Plantation Sectors, will get busy once again. Simply because of positive quarterly results. Don't ignore and be upset when they are falling. Keep collecting, as the Short Term returns look promising for them.

Friday, October 13, 2017

Banks, Finance and Insurance Index - heading towards its' all time highs of 19913 points

BFI index represents a good portion of the market in terms of the Market Capitalization. As such its' progress is very crucial for the ASI. As I have been pointing out, the BFI surpassed the highs of the 2010/2011 period and hit an all time high of 19913 points during August 2015, just after the General Elections. Thus re-rating the momentum of the sector. However it retraced to the supports of 2012/2013 periods and consolidated within 14000 points and 16700 points for a period of 15 months.

This has now found its' momentum build up, and forming a strong support at 16000 points. At present it needs to form a strong base between 16000 and 17850 points before a breakout and trending up to test the present all time high of 19913 points. Expect a pause in the index during the early part of next week and progress towards a trend extension thereafter.

Friday, October 6, 2017

ASI Today - 06.10.2017

So the ASI continued in the trend continuation. Once again the retailers kept busy going about trading their favourites.

The activity levels of the Plantation Sector increased, whilst the number of trades in the Banking Sector came 2nd. When Plantations witnessed 1845 transactions, with 75.5M in T/O, Banking gave 444.40 in T/O with 1133 trades. As the ASI brought in 922M of T/O, what contributed by Banks was about 48%. Manufacturing with 1191 trades became the 3rd heavily traded sector, but it was the 2nd highest Sector in terms of T/O with 247.1M.

MHDL was the highest traded counter, and along with this LDEV witnessing 232 trades dominated Land and Property Sector. However LDEV manages Agarapathana Plantations, hence it is more like a company that needs to be monitored with the Plantations than with L&P sector.

Sampath and Commercial Banks saw a lot of participation primarily by foreign and local investors, along side some local traders. Sampath saw a T/O 149.5M, in the normal board, whilst 154.5M came in from a Crossing. Sampath saw a high of 327, and Comb saw a high of 147.90.

Retailers kept mopping up Plantations with ELPL being the top trader, as MAL saw 341 trades. BALA came out of the accumulation to break out of 39. LDEV too witnessed mopping up yet it is trading below the present high of 12.80.

Tokyo saw a crossing of over 2M shares, perhaps the last stages of the Foreign selling. Need to keep an eye on this.

As mentioned yesterday I prefer to track the weekly ASI chart, and the key area to test is 6650. As the ASI closed at 6529 today it is about 130 points above. The 200 DMA looks a support at present which is around 6397 points.

The activity levels of the Plantation Sector increased, whilst the number of trades in the Banking Sector came 2nd. When Plantations witnessed 1845 transactions, with 75.5M in T/O, Banking gave 444.40 in T/O with 1133 trades. As the ASI brought in 922M of T/O, what contributed by Banks was about 48%. Manufacturing with 1191 trades became the 3rd heavily traded sector, but it was the 2nd highest Sector in terms of T/O with 247.1M.

MHDL was the highest traded counter, and along with this LDEV witnessing 232 trades dominated Land and Property Sector. However LDEV manages Agarapathana Plantations, hence it is more like a company that needs to be monitored with the Plantations than with L&P sector.

Sampath and Commercial Banks saw a lot of participation primarily by foreign and local investors, along side some local traders. Sampath saw a T/O 149.5M, in the normal board, whilst 154.5M came in from a Crossing. Sampath saw a high of 327, and Comb saw a high of 147.90.

Retailers kept mopping up Plantations with ELPL being the top trader, as MAL saw 341 trades. BALA came out of the accumulation to break out of 39. LDEV too witnessed mopping up yet it is trading below the present high of 12.80.

Tokyo saw a crossing of over 2M shares, perhaps the last stages of the Foreign selling. Need to keep an eye on this.

As mentioned yesterday I prefer to track the weekly ASI chart, and the key area to test is 6650. As the ASI closed at 6529 today it is about 130 points above. The 200 DMA looks a support at present which is around 6397 points.

Wednesday, October 4, 2017

ASI Today - 04.10.2017, weekly chart is looking great. Can expect a 100 point rise!!!

Today's Market was not that friendly for all retailers. Yet it offered opportunities for those who act with patience and plan. The T/O was huge, and totalled 2.44B.

As I've been commenting, (well it is not only me but many would agree), that those heavily traded stocks which had brought Retailers and Large traders to the Market has to Consolidate. They must be given some amount of breathing space to accumulate and get those impatient, directionless traders to exit, and sell, in the process allow those who see the potential of those counters to collect and wait for the next move. The noticeable feature is that this side way movement is not at all corrective, that is because the tiny pauses the stocks go into are treated as quick collections to be grabbed by many, thanks to the expected Profit growths in these counters.

As noticed the amount of transactions dropped in the ASI, after hitting an unbelievable number of 10204 trades on the 2nd instant, it fell to 7220 in today's trades. This gives all Retailers that nothing goes up in one line nor vise versa. You must be geared and prepared for the worse case. UNLESS YOU KNOW TO MANAGE YOUR RISK you will be lost, and your trading will make you a loser. I suggest you to trade in small volumes and kick your GREED off.

When the Plantations and few other actively traded stocks went in a slow pace, the BANKS and a few S&P SL 20 counters dashed in with a vengeance. Commercial Bank Voting can never be traded by those short term traders. If that had to be taken up to it's rightful place, the Big Investors and Traders should get into action. That's what happened today. There were 3 major trades in COMB, 10 M @ 145, whilst 2.36M in 2 blocks went @ 146/=. All were bought by Foreigners. The next major trade was in HNB, with 102K traded @ 245.50. In the Normal Board there were 326 transactions in COMB between 140.50 and 146.50, while closing @ 146.00. All though HNB was not in the top 25 heavily traded list it had 50 trades between 245 and 246.10, finally closing @ 246.00. JKH is trending at the higher end of the channel, between 160 and 165, closed @ 164/=. The major mind blower still is SAMP - with 165 trades and T/O of 27M, it traded between 320/= and 325/50.

As sectors we saw 1941 trades in the Banking sector chipping with a whopping T/O of 2.14B taking the BFI index up by 235 points, whilst the near 2nd was the Traders darling - Plantation Sector. It saw 1648 trades with 63M in T/O, but it dropped marginally by 8.04 points. Manufacturing was the 3rd highest traded with 954 trades, but dropping by 16.48 points. The 4th being Land & Property Sector where we saw 712 trades with the index being unchanged.

I expect Friday's trading to be somewhat lacklustre as it is a day between 3 holidays and being the last day of the week, but could be an occasion to go shopping if the retail stocks continue to retrace. Yet the bulls wont just give lightly on Banks and plantations.

WEEKLY ASI CHART - 100 points rise could be on the cards........ have a look at the chart.

As I've been commenting, (well it is not only me but many would agree), that those heavily traded stocks which had brought Retailers and Large traders to the Market has to Consolidate. They must be given some amount of breathing space to accumulate and get those impatient, directionless traders to exit, and sell, in the process allow those who see the potential of those counters to collect and wait for the next move. The noticeable feature is that this side way movement is not at all corrective, that is because the tiny pauses the stocks go into are treated as quick collections to be grabbed by many, thanks to the expected Profit growths in these counters.

As noticed the amount of transactions dropped in the ASI, after hitting an unbelievable number of 10204 trades on the 2nd instant, it fell to 7220 in today's trades. This gives all Retailers that nothing goes up in one line nor vise versa. You must be geared and prepared for the worse case. UNLESS YOU KNOW TO MANAGE YOUR RISK you will be lost, and your trading will make you a loser. I suggest you to trade in small volumes and kick your GREED off.

When the Plantations and few other actively traded stocks went in a slow pace, the BANKS and a few S&P SL 20 counters dashed in with a vengeance. Commercial Bank Voting can never be traded by those short term traders. If that had to be taken up to it's rightful place, the Big Investors and Traders should get into action. That's what happened today. There were 3 major trades in COMB, 10 M @ 145, whilst 2.36M in 2 blocks went @ 146/=. All were bought by Foreigners. The next major trade was in HNB, with 102K traded @ 245.50. In the Normal Board there were 326 transactions in COMB between 140.50 and 146.50, while closing @ 146.00. All though HNB was not in the top 25 heavily traded list it had 50 trades between 245 and 246.10, finally closing @ 246.00. JKH is trending at the higher end of the channel, between 160 and 165, closed @ 164/=. The major mind blower still is SAMP - with 165 trades and T/O of 27M, it traded between 320/= and 325/50.

As sectors we saw 1941 trades in the Banking sector chipping with a whopping T/O of 2.14B taking the BFI index up by 235 points, whilst the near 2nd was the Traders darling - Plantation Sector. It saw 1648 trades with 63M in T/O, but it dropped marginally by 8.04 points. Manufacturing was the 3rd highest traded with 954 trades, but dropping by 16.48 points. The 4th being Land & Property Sector where we saw 712 trades with the index being unchanged.

I expect Friday's trading to be somewhat lacklustre as it is a day between 3 holidays and being the last day of the week, but could be an occasion to go shopping if the retail stocks continue to retrace. Yet the bulls wont just give lightly on Banks and plantations.

WEEKLY ASI CHART - 100 points rise could be on the cards........ have a look at the chart.

Tuesday, October 3, 2017

BALA - Must consolidate to hit 40 and beyond

BALA - In 2012 there was a strong resistance area between 33 and 38, whilst it hit higher to test 44 as well. We could expect a consolidation in this area before the next trend continuation. As the expected fundamentals are strong we can not expect the bullish expectations to exacerbate just yet.

You need to accumulate on weakness, as this counter is certainly not done yet.

You need to accumulate on weakness, as this counter is certainly not done yet.

ASI Today - 03.10.2017

ASI - If yesterday was the day of the Retailers domain, today the game changed towards the Big guns. Turnover was relatively considerable, as it exceeded 1 billion to register at LKR 1,345,283,456. Momentum is turning out to be more towards a trend continuation in the overall market. But the trend witnessed in the retail savvy counters checked in for some breathing space vis a vis a consolidation. But too early to say it is corrective in nature. We need to give it time, perhaps 2 or 3 days.

Mostly Traded stocks were:

One Stock that took my breath away was Sampath Bank. It screamed through to 320.10, finally to close at 320.00. This stock is trending up while there is a rights issue @ 245/00. As such need to keep our ears to the ground until it goes XR, and the Rights hit the market for trading.

Mostly Traded stocks were:

| Symbol | Share Volume | Trade volume | Change (Rs.) | Change Percentage (%) |

| ELPL.N0000 | 5,172,415 | 1,120 | 2 | 6.62 |

| LCEM.N0000 | 3,605,998 | 624 | -0.3 | -3.75 |

| MAL.N0000 | 2,009,025 | 522 | 0.2 | 1.63 |

| LDEV.N0000 | 1,844,672 | 478 | 0 | 0 |

| BALA.N0000 | 666,707 | 468 | 0 | 0 |

| ACME.N0000 | 1,843,729 | 395 | 0.2 | 3.17 |

Whilst the stocks that came out of their consolidations were:

| Symbol | Share Volume | Trade volume | Change (Rs.) | Change Percentage (%) |

| COMB.N0000 | 309,464 | 175 | 2.2 | 1.59 |

| JKH.N0000 | 492,394 | 83 | 1 | 0.61 |

| CFVF.N0000 | 186,404 | 112 | 1.5 | 4.34 |

One Stock that took my breath away was Sampath Bank. It screamed through to 320.10, finally to close at 320.00. This stock is trending up while there is a rights issue @ 245/00. As such need to keep our ears to the ground until it goes XR, and the Rights hit the market for trading.

TKYO, JKH and NEST had Crossing Trades totaling over 476 million.

Trend continuation is now in place and the resistance between 6500 and 6600 is the area the index needs to pierce through. Hope it will happen and head higher.

Monday, October 2, 2017

Plantations Index

PLT - Plantations moved into a long rally since late March of this year. It closed yesterday at 1083 area. Whilst the fib extension of the 1st uptrend from Late March to late May, suggests that the 161.8% completion takes place around 1097 points. But the momentum of the counters in the sector is not showing considerable retracements mainly due to the strong growth expectations in this sector, after many torrid and dismal years. However the time is not right to invest into these counters but has a lot of steam for traders. So they should sieze the opportunity and enjoy the ride by keeping strict money management techniques.

ASI Today - 02.10.2017

ASI - Closed 32 points ahead of the previous close at 6470.96 points. Turnover was 549.47M, lower than previous. But the transactions exceeded 10,204 that was stupendous, given the Turnover levels. This clearly showed the level of interest by Retailers in action. As such the Market was highly concentrated on the Plantation Stocks, coupled with a few trading stocks.

Heavily Traded Stocks were:

Lanka Cement - 866 trades. T/O 33M, +1/50(22.73%)

Lankem Development - 784 Trades. T/O 35.4M, +1/10(10%)

Balangoda Plantations - 768 Trades. T/O 37.1M, +6.10(20%)

Malwatte Valley Plantations - 757 Trades. T/O 41.7M, +1.80(17.1%)

Malwatte Valley Plantations (Non Voting) - 657 Trades. T/O 20.6M, +1.90(18.63%)

Apart from the top 5 above Madulsima Plantations, ACME, Maskeliya Plantations and Lanka Orix Finance captured the Traders attention. Acme, LOFC and LCEM came in as new entrants to a much dominated Plantations counterparts.

However it was the S&P SL 20 heavy weights that took the ASI up. The major contributors were:

Ceylon Tobacco - 20 Trades. T/O 19.07M, +29/-(2.99%)

Cargills - 41 Trades. T/O 3.6M, +8.10(4.22%)

LOLC - 86 Trades. T/O 39.4M, +5/-(3.94%)

HNB - 23 Trades. T/O 13.4M, +5/-(2.13%)

Sampath - 72 Trades. T/O 22.8M, +1/50(.49%)

JKH - 49 Trades. T/O 13.7M, +1/50(.92%)

The movements we saw in the blue chips are encouraging, and we can expect a positive momentum for tomorrow as well.

There are day trading opportunities, but one must never trade without money management strategies.

There was one solitary LION trade that was over 20M(Crossing) chipping in 24M.

Heavily Traded Stocks were:

Lanka Cement - 866 trades. T/O 33M, +1/50(22.73%)

Lankem Development - 784 Trades. T/O 35.4M, +1/10(10%)

Balangoda Plantations - 768 Trades. T/O 37.1M, +6.10(20%)

Malwatte Valley Plantations - 757 Trades. T/O 41.7M, +1.80(17.1%)

Malwatte Valley Plantations (Non Voting) - 657 Trades. T/O 20.6M, +1.90(18.63%)

Apart from the top 5 above Madulsima Plantations, ACME, Maskeliya Plantations and Lanka Orix Finance captured the Traders attention. Acme, LOFC and LCEM came in as new entrants to a much dominated Plantations counterparts.

However it was the S&P SL 20 heavy weights that took the ASI up. The major contributors were:

Ceylon Tobacco - 20 Trades. T/O 19.07M, +29/-(2.99%)

Cargills - 41 Trades. T/O 3.6M, +8.10(4.22%)

LOLC - 86 Trades. T/O 39.4M, +5/-(3.94%)

HNB - 23 Trades. T/O 13.4M, +5/-(2.13%)

Sampath - 72 Trades. T/O 22.8M, +1/50(.49%)

JKH - 49 Trades. T/O 13.7M, +1/50(.92%)

The movements we saw in the blue chips are encouraging, and we can expect a positive momentum for tomorrow as well.

There are day trading opportunities, but one must never trade without money management strategies.

There was one solitary LION trade that was over 20M(Crossing) chipping in 24M.

Sunday, October 1, 2017

BFI - Banks, Finance and Insurance Index is ahead of the ASI

The All time high of the All Share Index was in Feb of 2011 @ 7825 points, but the Banking,Finance and Insurance sector index known as BFI has broken out of it's 2011 highs and hit the all time high in August of 2015. Therefore it is clear that this Sector is trading ahead of the ASI.

But as we know this sector as well as the Economy of the country is going through a lot of re-positioning, hence a lengthy consolidation can be seen in the price action of the index above 14000 points, with a strong support at 16000 which was an important support between 2010 and 2011 period. This will re-test it's all time high of 19913 points eventually with a short term resistance at 17627 points. At present it is above the support at 16000 as it closed at 16610 points on Friday the 29th ultimo.

But as we know this sector as well as the Economy of the country is going through a lot of re-positioning, hence a lengthy consolidation can be seen in the price action of the index above 14000 points, with a strong support at 16000 which was an important support between 2010 and 2011 period. This will re-test it's all time high of 19913 points eventually with a short term resistance at 17627 points. At present it is above the support at 16000 as it closed at 16610 points on Friday the 29th ultimo.

Subscribe to:

Comments (Atom)

Loss and Gain of the ASI in 2021 vs the Loss in 2022

This ASI chart shows the All time high in 2021 of 9025.82 on the 29th 0f Jan'21 and the fall to the yearly low of 6852.64 on the 19th ...

-

This ASI chart shows the All time high in 2021 of 9025.82 on the 29th 0f Jan'21 and the fall to the yearly low of 6852.64 on the 19th ...

-

Dr. Michael Burry is the ONE EYED Physician turned Fund Manager, who figured out that the Housing Market in the US is going to fall apart,...