Turnover was LKR 1.17B. Mainly from the blue chips. The retailers too had their say in some of the counters. SAMP was the biggest performer having a T/O of LKR 240.8M, entirely in the Normal board. CCS,HHL,HNB,JKH and LLUB helped to beef up the T/O. Whilst the retailers commanded the speed in counters like BFN,TFC.X,JINS and SIRA with higher trading numbers. All in all there were 5143 trades.

It was a good day as many counters, large counters in particular kept the market alive. Expect this momentum to persist tomorrow too, as the demand for the Banks and some blue chip counters are still intact.

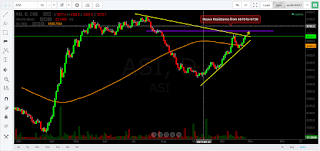

ASI edged over the top yellow trend line I was showing you yesterday. It is now trying to test 76.40% fib ret line at 6670 points which is only 40 points away as the ASI closed the at 6633 points.

Main catalyst for the market to be buoyant will be the quarterly announcements and the bullish international markets. Some are pinning hopes on a positive business friendly budget in November as well. As such there is a confluence of many positive developments as against the negatives.

Surpassing 6670 points will open up the index to face the strong resistance coming from the top end of the previous rally. That is something that we need to watch now. If the market is going to pierce through that channel of resistance then the BANKS must perform very strongly. Let's hope for the best.

Making money in the Stock Market is not easy, but not hard only with increased education and understanding.......

Subscribe to:

Post Comments (Atom)

Loss and Gain of the ASI in 2021 vs the Loss in 2022

This ASI chart shows the All time high in 2021 of 9025.82 on the 29th 0f Jan'21 and the fall to the yearly low of 6852.64 on the 19th ...

-

This ASI chart shows the All time high in 2021 of 9025.82 on the 29th 0f Jan'21 and the fall to the yearly low of 6852.64 on the 19th ...

-

Dr. Michael Burry is the ONE EYED Physician turned Fund Manager, who figured out that the Housing Market in the US is going to fall apart,...

No comments:

Post a Comment