For 10 straight weeks the ASI fell 332 points. But this week being the final week for 2017, we saw the index recording a gain of 50 points. That is huge given the lackluster behaviour due to the holiday mood. However 1 week of gains won't mean a thing if the activity is going to be erratic. Even if some may not agree the economic indicators have shown a better year compared to the previous 2 years. As such the market ended by closing at 6369.30 which was higher than the open of the year which was 6228.30. Although it was marginal yet it makes sense alongside the explanation above. Therefore I like to image 2017 as a YEAR OF RECOVERY for the CSE, and the New Year to be the BEGINNING OF GROWTH. My top side expectation for the Index is to test 7000 points DURING the Year with the bottom side being 6000 points. Therefore the behaviour will certainly be volatile within an upward trend.

Making money in the Stock Market is not easy, but not hard only with increased education and understanding.......

Friday, December 29, 2017

Wednesday, December 27, 2017

Plantations - testing the 100sma.....who capitalized on the drop?

As we all saw the prices retraced a bit, in some instances dropped 5 to 10% and more. Only the bold and confident ceased the moment. Still it is not late. Collect and accumulate as the short to medium potential is very high on the plantations.

As it tested the 100 sma, there can be a retracement and a consolidation down to 955 points and hit higher to test 987 points.

As it tested the 100 sma, there can be a retracement and a consolidation down to 955 points and hit higher to test 987 points.

Friday, December 22, 2017

Seasons Greetings

My dear readers and friends,

May I take this opportunity to extend my warmest wishes and blessings this season. Enjoy the Holidays while sharing your Love and Joy with all you meet.

Season's Cheers From Me...........

May I take this opportunity to extend my warmest wishes and blessings this season. Enjoy the Holidays while sharing your Love and Joy with all you meet.

Season's Cheers From Me...........

Monday, December 18, 2017

Plantations - Blessing in disguise

Ok a lot of the players are in 2 minds as to what they should be doing with plantations stocks, after the news that the Russians are restricting the purchase of Agri Products including tea.

Thank God for Tea. It is a natural beverage, as such the Ceylon Tea can't be replaced just because you buy teas produced in India, Kenya, Vietnam or China, or even Russia, as they too produce tea. Just think if Russians are making tea why on earth they love Ceylon Tea. We as Sri Lankans have not tasted teas from Kenya or India as we consume our own and won't allow those teas coming to the shelves of our Stores at any rate. So we do not know the difference, but if you have had the luxury of tasting those teas you will know the value of Ceylon Tea, it is a Gift that has come to Sri Lanka.

Key players in the game of Tea are aware of what's going on, and they won't be disturbed. But they surely will keep a closer look at HOW THE HIGHER AUTHORITIES are handling the issue. IT IS TOTALLY UPTO THESE BIG WIGS TO HANDLE IT PRUDENTLY. The time duration of resolving will be based on the negotiations. It can be within days, weeks or perhaps months to come to a settlement.

Key players in the game of Tea are aware of what's going on, and they won't be disturbed. But they surely will keep a closer look at HOW THE HIGHER AUTHORITIES are handling the issue. IT IS TOTALLY UPTO THESE BIG WIGS TO HANDLE IT PRUDENTLY. The time duration of resolving will be based on the negotiations. It can be within days, weeks or perhaps months to come to a settlement.

Russians take the bulk of their teas in to the their lands before the 15th of November to sell before Christmas. Thereafter the Traders go on Christmas Holidays, and will be back only after the 15th of January. So the timing by the Russian Authorities have been safe, for their consumers as well as for our Shippers since the Bomb shell fell only during the holiday period. As far as Tea auctions here are concerned, there wont be a sale in the last week of the year ie. next week. That too is not exciting and panicking the Shippers.

Hopefully the Team that has been given the responsibility of resolving would finish it before the Shippers get excited in the Month of January.

During this period the Prices of Plantations will fluctuate, but once all is done and life gets back to normal, the Prices will shoot in stocks and Auctions as well.

That is why this is a blessing in disguise. Capitalize on it, as the time is short.

Thank God for Tea. It is a natural beverage, as such the Ceylon Tea can't be replaced just because you buy teas produced in India, Kenya, Vietnam or China, or even Russia, as they too produce tea. Just think if Russians are making tea why on earth they love Ceylon Tea. We as Sri Lankans have not tasted teas from Kenya or India as we consume our own and won't allow those teas coming to the shelves of our Stores at any rate. So we do not know the difference, but if you have had the luxury of tasting those teas you will know the value of Ceylon Tea, it is a Gift that has come to Sri Lanka.

Key players in the game of Tea are aware of what's going on, and they won't be disturbed. But they surely will keep a closer look at HOW THE HIGHER AUTHORITIES are handling the issue. IT IS TOTALLY UPTO THESE BIG WIGS TO HANDLE IT PRUDENTLY. The time duration of resolving will be based on the negotiations. It can be within days, weeks or perhaps months to come to a settlement.

Key players in the game of Tea are aware of what's going on, and they won't be disturbed. But they surely will keep a closer look at HOW THE HIGHER AUTHORITIES are handling the issue. IT IS TOTALLY UPTO THESE BIG WIGS TO HANDLE IT PRUDENTLY. The time duration of resolving will be based on the negotiations. It can be within days, weeks or perhaps months to come to a settlement.Russians take the bulk of their teas in to the their lands before the 15th of November to sell before Christmas. Thereafter the Traders go on Christmas Holidays, and will be back only after the 15th of January. So the timing by the Russian Authorities have been safe, for their consumers as well as for our Shippers since the Bomb shell fell only during the holiday period. As far as Tea auctions here are concerned, there wont be a sale in the last week of the year ie. next week. That too is not exciting and panicking the Shippers.

Hopefully the Team that has been given the responsibility of resolving would finish it before the Shippers get excited in the Month of January.

During this period the Prices of Plantations will fluctuate, but once all is done and life gets back to normal, the Prices will shoot in stocks and Auctions as well.

That is why this is a blessing in disguise. Capitalize on it, as the time is short.

Tuesday, December 12, 2017

LDEV - Told not to trade. Time to collect!!!

LDEV has now made a low of 6/- after it went XR. Thereby forming a huge gap between 10.40 and 7.30. It is now worth collecting with a stop at 6/-. The upward momentum could test 7/50 to 8/- in the short term, which could extend to test 9/- with a strong consolidation.

Plantations - Interesting momentum build up time to buy

Today's close on the Plantations was very interesting. The positive levels of activity could take the momentum forward to higher levels, but the behaviour of the price levels will have to be watched very carefully. The time to buy plantations has come.......

Saturday, December 9, 2017

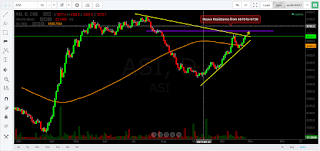

ASI Weekly Chart - No signs of a recovery. However watch the coming week

ASI is continuing on it's down trend on the weekly chart. This suggest that there is no major reversal at this time. However we must watch the impact of the coming week to understand the way forward.

Support at present is between 6240 and 6375.

One good thing is that there are many counters to collect and accumulate at attractive valuations.

Support at present is between 6240 and 6375.

One good thing is that there are many counters to collect and accumulate at attractive valuations.

Wednesday, December 6, 2017

JKH - Trades in a tight channel

A narrow channel between 153.60 to 154.70 helping the counter to be supported. The present resistance is at the swing high of 156, with the support is at the present swing low of 149. Only relief is the levels of volume that are being accumulated. Collect only if you would average down,else stay away.

Plantations - Can it hold above 900?

Plantations have headed back to the support channel. Need to stay above 900 points. 18.2 points away at present. No signs to be interested in the counters as yet.

Tuesday, November 28, 2017

JKH - Trend reversed

JKH succeeded to reverse up. A relief for the overall market as well. As long as the present swing low of 149 is held, it will be in a trend extension. The present resistance is a test at 158, and a successful breakout will take it to 160. Let's see how long it would take to test 158/= in the first place. That being said the Volumes will certainly play a major role.

Saturday, November 25, 2017

ALUM - Trending -/60 cents above the 52 weeks low - Watch!!!

ALUM - Has retraced from a 52 week high of 25.40 to the present 19/=. The 52 week low for the counter was 18.40. Which means that the stock gained 7/= from the low to the high. The present loss therefore is 6/40. That's a retracement of 91.4%(6.40/7*100). This is an interesting development. Along with this the RSI has fallen to the 52 week lowest range of 22.50 to 23 points. There had been an important volume change that happened on the 20th Nov '17 where 1.023M shares had traded, which was an above average trade. We saw their profits increasing from 43M to 83M from JUN to SEPT, that is a significant growth of 93% QoQ. The negative for the counter is the present Aluminum prices in the world markets. It has increased quite considerably.

I expect a trend reversal on this counter in the Short term. Therefore adding this to your watch list will be highly useful. Have a closer look at this counter.

I expect a trend reversal on this counter in the Short term. Therefore adding this to your watch list will be highly useful. Have a closer look at this counter.

Friday, November 24, 2017

ASI - Another trend failure

ASI - Saw another trend failure, and heading to a support area of 6349 and 6400. The recovery that occurred on the 16th November where the index trailed up from 6421 toned down the oversold situation but is now under threat. There is no sign of a recovery yet which is to be watched closely.

Thursday, November 23, 2017

AEL - At a critical support area. Watchout!!!

AEL - Trading at a critical Support Range between 23.50 and 24.00 Watch for the trend reversal. We saw a Trend reversal taking place on 2 occasions around this Support area. Present RSI is at a 52 weeks low hitting 14 points on the 22nd Nov'17. Wait for the confirmation with a bullish divergence and an impulsive Candle with volume.

Friday, November 17, 2017

SAMP - Need to close above 350 for obvious reasons

Sampath Plc saw above average volumes trading in the last 2 days. Along with volumes the prices shot up from a low of 320 to a high of 345.40. An increase of 25.40 in a matter of 2 days. That shows how tightly the counter is held, where the buyers need to pay a premium to lure the sellers in. This is a clear indication of higher price levels for the bank in the way forward.

In order for the price to TC (Trend Continuation), then 350 must be broken on closing basis. If one is to base the traded volumes, it will be a no brainer for it to test 350 at the beginning of next week. In the medium to long term the Share Holders of Sampath Bank will enjoy higher prices due to the strong Fundamentals they show.

In order for the price to TC (Trend Continuation), then 350 must be broken on closing basis. If one is to base the traded volumes, it will be a no brainer for it to test 350 at the beginning of next week. In the medium to long term the Share Holders of Sampath Bank will enjoy higher prices due to the strong Fundamentals they show.

LDEV - held within yesterday's range

LDEV - Ok it didn't extend, but the bulls on the counter would have been relieved to see that the Candle today was within the Candle of yesterday. The reason for them to be happy is that the volume of yesterday was 1.8M, and today's volume was much lower at 181K. That means they manged to keep the bears in control. A close above 13.50 could make the bullish trend strong, whilst the bears will be over-joyed to see it's closing below 11.50, which is the present swing low. For the trend to be very strong the volumes should be atleast above 500k for a continued number of days. In excess of 1M, will be great. Let's see how powerful the bulls are.....

Plantations couldn't extend

Plantations tested the resistance area around 990 yesterday, but couldn't extend. The chart that was posted is given below:

The present low is 944 points, and would be nice to see it is held. Failure to do so, it will find support in the channel between 899 and 956. Expectations of a growth in the Profits of Plantation Stocks will keep the index at a higher low, which is very bullish. Let's see what's that Higher Low going to be.

The present low is 944 points, and would be nice to see it is held. Failure to do so, it will find support in the channel between 899 and 956. Expectations of a growth in the Profits of Plantation Stocks will keep the index at a higher low, which is very bullish. Let's see what's that Higher Low going to be.

Thursday, November 16, 2017

LDEV - Can it succeed on a trend continuation?

LDEV - to move into a trend continuation, the counter needs to break the recent high of 14.50. If it won't succeed then we will not see a trend continuation before the present pull back is over.

The candles of the preceding last 3 days formed a swing low, with a high of 13.40 and a low of 11.50. Today's range was between 12.60 and 13.20, which is within the range of the swing low formation. Any one trading could buy within the said channel, provided that the stop loss is made 10 cents below the swing low of 11.50. If you don't want to stop loss then it may not be advisable to trade the counter.

The candles of the preceding last 3 days formed a swing low, with a high of 13.40 and a low of 11.50. Today's range was between 12.60 and 13.20, which is within the range of the swing low formation. Any one trading could buy within the said channel, provided that the stop loss is made 10 cents below the swing low of 11.50. If you don't want to stop loss then it may not be advisable to trade the counter.

JKH - sorry that I missed to update...

On the 27th of September '17 I reported that JKH was trending within a channel between 160-165. The price failed to hold the channel and the rest is history.

The chart posted then is given here:

Present falling knife trend is not at all attractive for the counter. The momentum built with this rapid fall won't be reversed soon, until a consolidation takes place. That too needs time. Today's pin bar candle with a long upper wick is more of a bearish nature as it is preceding a long bearish candle. As such the down trend is on, and will not be over soon. Therefore any upside must be used to sell. Buying to trade will not be a good idea as yet.

The chart posted then is given here:

Present falling knife trend is not at all attractive for the counter. The momentum built with this rapid fall won't be reversed soon, until a consolidation takes place. That too needs time. Today's pin bar candle with a long upper wick is more of a bearish nature as it is preceding a long bearish candle. As such the down trend is on, and will not be over soon. Therefore any upside must be used to sell. Buying to trade will not be a good idea as yet.

Plantations touched the 1st resistance....but did not close above

In my Plantations chart yesterday I showed the 1st resistance around 990-1000 points. Price line did touch the area but did not close above that. Tomorrow's performance will be important. Whilst respecting the uptrend that the sector is enjoying since March '17, I do not think that the trend continuation will happen just yet. Therefore need to see the behavior with caution. Trade with Strict Stop Losses.

Wednesday, November 15, 2017

Plantations are up..... but may not break the new highs soon

As the plantation stocks recovered it is important to remind ourselves that unless the present highs are broken the up move will not sustain. As such whoever wants to trade need to understand the risk of getting caught to a rally which is false. The index on Plantations saw the price line taking support at the upper end of the yellow channel at 944 today. We might see it moving up to test 995-1000 points in the next few days,but may not break above that. A reversal from there onwards will take it down to the support region once again. If my expectation of a trend failure is wrong and the index move further, then 1035/1040 is what to expect.

If one would want to indulge in short term trading, then the stop loss is necessary below the present low.

If one would want to indulge in short term trading, then the stop loss is necessary below the present low.

Thursday, November 9, 2017

Plantatins Index (PLT) will take support within 897 and 955 Points

Did you know that the beginning of the Plantations rally had started in December 2016? (infact there had been a trend reversal that had happened way back in April '16 too) Thereafter it had consolidated in June 2017. Once again the Trend continuation had resumed in July. So now what?

Another consolidation. I expect this consolidation and trend reversal to bring the index down to a channel between 897 and 955 points. If the plantation index is retracing then obviously the stocks in it will retrace too. I expect the Tea Average Prices to come down. along with that the profitability of the Companies.. But the averages will be healthy for companies to show consistent profits YoY. The growth effects will help the Stock prices also to fluctuate tremendously. Therefore you will have regular trading opportunities. However please have strict Money Management Strategies when trading the Plantations. Talk to your Broker for the suitable money management strategies. If you do not get any help,feel free to talk to me.

Another consolidation. I expect this consolidation and trend reversal to bring the index down to a channel between 897 and 955 points. If the plantation index is retracing then obviously the stocks in it will retrace too. I expect the Tea Average Prices to come down. along with that the profitability of the Companies.. But the averages will be healthy for companies to show consistent profits YoY. The growth effects will help the Stock prices also to fluctuate tremendously. Therefore you will have regular trading opportunities. However please have strict Money Management Strategies when trading the Plantations. Talk to your Broker for the suitable money management strategies. If you do not get any help,feel free to talk to me.

ASI - Survived to hold the 100 SMA, lower trend line got rejected

ASI failed to hold above the lower trend line. But survived the 100 sma. There is a major support area around 6500 as shown by the horizontal trend line drawn in yellow. Needs to hold that to motivate the sentiments. Failure there could test the trend line in red. There are no signs of a trend reversal to the up as yet. I still want to respect the uptrend that started since March. If the ASI fail to hold above 6349, it will not sound good at all.

Sunday, October 29, 2017

What to look for in the ASI during the week ahead?

ASI no doubt tried to move towards the heavy resistant area coming from the previous rally. But stalled short of the 13th October high of 6648 points. Fridays close was lower than the previous day. The high of Thursday was higher than Friday's making a lower high in the daily candle. This is however happened within the present uptrend with higher lows, that started from early September. Therefore we need to bow down to this up-trend until we see a failure below 6346 points, which happened to be the trend reversal that occurred during the start of the trend. As shown in the chart the market is sitting within a trend line drawn by connecting lower highs, and another line connecting the higher lows, which is a typical symmetrical triangle, that happens when the market is wanting to find a direction. As we are at the tip of the 2 trend lines the massage is clear. Any thing could happen either to break out of the top line or the bottom. Therefore having long positions to trade may not be the best, until a trend continuation is confirmed by breaking out of the upper trend line. Stock specific trading strategies would be more preferred than trading stocks based on the ASI.

Thursday, October 26, 2017

ASI Today - 26.10.2017. Blue Chips ruled the day

Turnover was LKR 1.17B. Mainly from the blue chips. The retailers too had their say in some of the counters. SAMP was the biggest performer having a T/O of LKR 240.8M, entirely in the Normal board. CCS,HHL,HNB,JKH and LLUB helped to beef up the T/O. Whilst the retailers commanded the speed in counters like BFN,TFC.X,JINS and SIRA with higher trading numbers. All in all there were 5143 trades.

It was a good day as many counters, large counters in particular kept the market alive. Expect this momentum to persist tomorrow too, as the demand for the Banks and some blue chip counters are still intact.

ASI edged over the top yellow trend line I was showing you yesterday. It is now trying to test 76.40% fib ret line at 6670 points which is only 40 points away as the ASI closed the at 6633 points.

Main catalyst for the market to be buoyant will be the quarterly announcements and the bullish international markets. Some are pinning hopes on a positive business friendly budget in November as well. As such there is a confluence of many positive developments as against the negatives.

Surpassing 6670 points will open up the index to face the strong resistance coming from the top end of the previous rally. That is something that we need to watch now. If the market is going to pierce through that channel of resistance then the BANKS must perform very strongly. Let's hope for the best.

It was a good day as many counters, large counters in particular kept the market alive. Expect this momentum to persist tomorrow too, as the demand for the Banks and some blue chip counters are still intact.

ASI edged over the top yellow trend line I was showing you yesterday. It is now trying to test 76.40% fib ret line at 6670 points which is only 40 points away as the ASI closed the at 6633 points.

Main catalyst for the market to be buoyant will be the quarterly announcements and the bullish international markets. Some are pinning hopes on a positive business friendly budget in November as well. As such there is a confluence of many positive developments as against the negatives.

Surpassing 6670 points will open up the index to face the strong resistance coming from the top end of the previous rally. That is something that we need to watch now. If the market is going to pierce through that channel of resistance then the BANKS must perform very strongly. Let's hope for the best.

Wednesday, October 25, 2017

ASI today - 25.10.2017. Retailers showed robust activity

ASI mainly belonged to the retailers today. If you happen to be one such retailer, ask yourself, as to why you were wondering when many of your type are out in the field.

BFN, ACL, MAL, SAMP, MASK, GSF, CFVF, and VPEL were the stocks that they could participate quite liberally. Alongside there were Investors who picked up Stocks such as SAMP by paying premiums, showing the confidence behind the Stock.

Total T/O was LKR 892M+, out of which 38% was through crossings, whilst 62% came from the Normal Board activities. We witnessed 5946 transactions. Up over the last couple of days.

Some of the blue chips are waning out in the likes of JKH. But there was a block trade on it. Hopefully a foreign buy. Banks hit another round of a Trend continuation, after a slight consolidation. Plantations are not that attractive, which is understandable after a non stop trend extension. However there is steam in it until the results are announced.

ASI is testing a critical area of resistance between 6610 and 6620, as it closed at 6615 points, with an intra-day high of 6622 points. We need to see a strong breakout from this area. Possibly it would be the banks and some not so regular blue chips such as BUKI helping to do so. Watch it.

BFN, ACL, MAL, SAMP, MASK, GSF, CFVF, and VPEL were the stocks that they could participate quite liberally. Alongside there were Investors who picked up Stocks such as SAMP by paying premiums, showing the confidence behind the Stock.

Total T/O was LKR 892M+, out of which 38% was through crossings, whilst 62% came from the Normal Board activities. We witnessed 5946 transactions. Up over the last couple of days.

Some of the blue chips are waning out in the likes of JKH. But there was a block trade on it. Hopefully a foreign buy. Banks hit another round of a Trend continuation, after a slight consolidation. Plantations are not that attractive, which is understandable after a non stop trend extension. However there is steam in it until the results are announced.

ASI is testing a critical area of resistance between 6610 and 6620, as it closed at 6615 points, with an intra-day high of 6622 points. We need to see a strong breakout from this area. Possibly it would be the banks and some not so regular blue chips such as BUKI helping to do so. Watch it.

Tuesday, October 24, 2017

ASI Today - 24.10.2017. ASCOT bought over by Foreign/Local Investors

Some lucky Traders capitalized on the ASCOT deal as it went up from 32 to 44.50 during intra-day trading. This was due to a group of Investors both Local and Foreign bought more than 44% upto a high of 42.50. When the 1st block crossed at 42/- it was trading at 33.00 in the normal board. This made the traders to JUMP AND BUY from the sellers. The lucky traders managed to grab roughly about 50K of shares below 38.00. They were the most benefited. A Mandatory Offer will be made at 42.50 as the Investors have exceeded 30% trigger.

More than LKR 250M worth of T/O came from ASCO, whilst the Balance LKR 490M, were shared among others, in a total T/O of LKR 743M+.

Another stage of the Plantations rally is on, and would exist till the Sept results are out. Yet this sector is highly volatile, which is famous for versatile surprises. Hence caution is the best medicine.

A further 17 points were added to the ASI today, and it stood at 6588 points in the end of trading.

Market was a bit busy today than yesterday, but has a long way to go.

There is a resistance around 6600 points to 6620 points. Need to see whether it will be respected.

More than LKR 250M worth of T/O came from ASCO, whilst the Balance LKR 490M, were shared among others, in a total T/O of LKR 743M+.

Another stage of the Plantations rally is on, and would exist till the Sept results are out. Yet this sector is highly volatile, which is famous for versatile surprises. Hence caution is the best medicine.

A further 17 points were added to the ASI today, and it stood at 6588 points in the end of trading.

Market was a bit busy today than yesterday, but has a long way to go.

There is a resistance around 6600 points to 6620 points. Need to see whether it will be respected.

Monday, October 23, 2017

ASI Today - Billion Rupee T/O, but mediocre activity

More than 500M came from 2 block trades in Sampath and Softlogic Holdings. Central Finance had a lot of attention today with more than a million shares trading, bringing in 120M+ in T/O.

The rest of the Market did not make any surprises, with the Index closing lower by 2 points. Plantations did a slight come back, after a few days of side way movement.

The ASI is still around 6570 points, with a side way consolidation. Eventhough the overall market is hanging in the balance there are opportunities for the active well planned traders. Whilst there is value to pick for the Investors too.

The rest of the Market did not make any surprises, with the Index closing lower by 2 points. Plantations did a slight come back, after a few days of side way movement.

The ASI is still around 6570 points, with a side way consolidation. Eventhough the overall market is hanging in the balance there are opportunities for the active well planned traders. Whilst there is value to pick for the Investors too.

Friday, October 20, 2017

ASI Today - 20.10.2017

Today's highlight was Chevron Lanka plc. This stock got hit so badly for many a month. Onslaught on the share was understandable, as their Market share and the Profits Dropped. Things got better in September. Their profits were better than the June quarter, and the dividend was slightly better than that of July. Investors rushed in to celebrate, and took it up to a slightly higher level. What closed yesterday at 112.70, closed at 118.50 today. Volume was also commendable.

There were many interesting stuff that happened in the Market besides Chevron, Sampath was traded for the last day before going XR on Monday. There were many collectors on that due to the arbitrage profit you could get. The busiest in the Plantation Co's was LDEV with more than 338k was changed hands.

T/O was lower at 568M. SL20 Stocks did not bring any surprises, hence it was business as usual.

ASI picked up thanks to Chevron increased by 17+ points. The 50% Fib ret of 6558 held, that is positive.

As shown in LLUB and VFIN, the market is positively responding to increased profits and growth in the quarterlies, which can keep the ASI busy in the coming weeks.

There were many interesting stuff that happened in the Market besides Chevron, Sampath was traded for the last day before going XR on Monday. There were many collectors on that due to the arbitrage profit you could get. The busiest in the Plantation Co's was LDEV with more than 338k was changed hands.

T/O was lower at 568M. SL20 Stocks did not bring any surprises, hence it was business as usual.

ASI picked up thanks to Chevron increased by 17+ points. The 50% Fib ret of 6558 held, that is positive.

As shown in LLUB and VFIN, the market is positively responding to increased profits and growth in the quarterlies, which can keep the ASI busy in the coming weeks.

Thursday, October 19, 2017

ASI Today - 19.10.2017

Turnover was over a Billion at 1070 M. That was significant as 725M were from the normal board, whilst 345M came from Crossings. JKH, NDB,SAMP and LLUB saw 553M worth of Turnover, making the bulk of the contribution. A special attention was given to TESS today with more than 7.5M shares trading among 412 trades. LLUB was the highest Traded with 500+ transactions, and 91M in T/O.

Overall the Market wasn't that active, but saw traders going about accumulating many Stocks in Plantations, Finance and Manufacturing sectors. Nothing out of the ordinary was witnessed except in TESS. Better watch that out as the volume traded was significant to ignore.

ASI has now come back to the 50% Fib retracement area that I plot at 6555 points. That is a critical support level. However it will be interesting to see whether it will hold above 61.8% fib ret at 6508 points.

There is no sign of a momentum build up yet in the ASI, which is closely watched.

Overall the Market wasn't that active, but saw traders going about accumulating many Stocks in Plantations, Finance and Manufacturing sectors. Nothing out of the ordinary was witnessed except in TESS. Better watch that out as the volume traded was significant to ignore.

ASI has now come back to the 50% Fib retracement area that I plot at 6555 points. That is a critical support level. However it will be interesting to see whether it will hold above 61.8% fib ret at 6508 points.

There is no sign of a momentum build up yet in the ASI, which is closely watched.

Tuesday, October 17, 2017

ASI Today - 17.10.2017

Market looked big today with 3 big crossings. Largest being the sale of the controlling stake of EAST, which was 63.91% or 88,345,235 shares of the Company. This deal brought in a T/O of 1095.5 M Rupees. The next 2 being COMB and CCS, adding another 488.9 M Rupees. The rest of the market chipped in with a T/O of 308.8 M.

The ASI shed another 23.89 points. It has now shed 76 points from it's swing high of 6648 points. The ASI rested nicely on the 100 sma today. But may not be for long. However 100sma is an important worm to look at.

Traders still have room to get busy on plantations, and expected growth stories on a few other counters. We witnessed robust collection on those counters.

Needless to mention the stocks that have gathered in steam at present as I have shared them in my previous post captioned " Stocks that are gathering momentum", will reward you, if you are bold enough to dabble in them.

It is highly advisable to accumulate the counters that can show growth, which are in plenty these days. Particularly when the market is in a pullback. That will be the only time you could do so.

The CSE will be on holiday tomorrow O/A Deepavali Festival.

The ASI shed another 23.89 points. It has now shed 76 points from it's swing high of 6648 points. The ASI rested nicely on the 100 sma today. But may not be for long. However 100sma is an important worm to look at.

Traders still have room to get busy on plantations, and expected growth stories on a few other counters. We witnessed robust collection on those counters.

Needless to mention the stocks that have gathered in steam at present as I have shared them in my previous post captioned " Stocks that are gathering momentum", will reward you, if you are bold enough to dabble in them.

It is highly advisable to accumulate the counters that can show growth, which are in plenty these days. Particularly when the market is in a pullback. That will be the only time you could do so.

The CSE will be on holiday tomorrow O/A Deepavali Festival.

Monday, October 16, 2017

Stocks that are gathering in momentum

Following stocks appears to be gathering momentum

CFVF - there is a strong support base forming between 38.50 and 39.00. If you have it keep an eye on. If you want to enter, try at the lower end of the channel i.e. 38.50.

RICH - A considerable volume traded at 14.00, as such the support now is between 13.50 and 14.00, but more biased towards 14.00.

SAMP - 340 has a good short term support, and the next support is around 338.50. The trend would resume it's ascent once the support is made very strong.

MBSL - Fair volume traded today mainly above 15.00. Presently the price is trying to breakout over 15.40, and with the present momentum build up we will see newer highs in the short term.

LDEV - strong accumulation at 13.50 and 13.60. Once the consolidation is complete this could test new highs.

MAL - 11.50 to 11.70 is where the support is. Accumulation will have to be at this range. Trend will continue once the accumulation is over.

MHDL - 2.12 million shares traded between 11 and 13.90 a few days ago. this has helped the stock to trade at the upper range of this channel. No signs of a trend continuation yet. Watch to collect low or wait for a higher close.

CFVF - there is a strong support base forming between 38.50 and 39.00. If you have it keep an eye on. If you want to enter, try at the lower end of the channel i.e. 38.50.

RICH - A considerable volume traded at 14.00, as such the support now is between 13.50 and 14.00, but more biased towards 14.00.

SAMP - 340 has a good short term support, and the next support is around 338.50. The trend would resume it's ascent once the support is made very strong.

MBSL - Fair volume traded today mainly above 15.00. Presently the price is trying to breakout over 15.40, and with the present momentum build up we will see newer highs in the short term.

LDEV - strong accumulation at 13.50 and 13.60. Once the consolidation is complete this could test new highs.

MAL - 11.50 to 11.70 is where the support is. Accumulation will have to be at this range. Trend will continue once the accumulation is over.

MHDL - 2.12 million shares traded between 11 and 13.90 a few days ago. this has helped the stock to trade at the upper range of this channel. No signs of a trend continuation yet. Watch to collect low or wait for a higher close.

ASI Today - 16.10.2017

ASI took a breather. As I expected the Banking index pulled Back. That was nothing extra-ordinary. All 3 big banks rallied non-stop, hence a cooling off. With the Banks pulling back the momentum of the Plantation Companies saw another day of consolidation. This sector too needed this break. My charts tell me that this is a healthy development.(Remember your chart is yours, and mine's mine. Better get that Straight)

T/O as well as Trades decreased. The most noticeable counters that ended positively were RICH and DIAL. Both had active trading. Expect the momentum to build up on RICH in particular, whilst DIAL needs to be seen.

Amidst the pullback Counters that were actively traded in the Banking and Plantation Sectors, will get busy once again. Simply because of positive quarterly results. Don't ignore and be upset when they are falling. Keep collecting, as the Short Term returns look promising for them.

T/O as well as Trades decreased. The most noticeable counters that ended positively were RICH and DIAL. Both had active trading. Expect the momentum to build up on RICH in particular, whilst DIAL needs to be seen.

Amidst the pullback Counters that were actively traded in the Banking and Plantation Sectors, will get busy once again. Simply because of positive quarterly results. Don't ignore and be upset when they are falling. Keep collecting, as the Short Term returns look promising for them.

Friday, October 13, 2017

Banks, Finance and Insurance Index - heading towards its' all time highs of 19913 points

BFI index represents a good portion of the market in terms of the Market Capitalization. As such its' progress is very crucial for the ASI. As I have been pointing out, the BFI surpassed the highs of the 2010/2011 period and hit an all time high of 19913 points during August 2015, just after the General Elections. Thus re-rating the momentum of the sector. However it retraced to the supports of 2012/2013 periods and consolidated within 14000 points and 16700 points for a period of 15 months.

This has now found its' momentum build up, and forming a strong support at 16000 points. At present it needs to form a strong base between 16000 and 17850 points before a breakout and trending up to test the present all time high of 19913 points. Expect a pause in the index during the early part of next week and progress towards a trend extension thereafter.

Friday, October 6, 2017

ASI Today - 06.10.2017

So the ASI continued in the trend continuation. Once again the retailers kept busy going about trading their favourites.

The activity levels of the Plantation Sector increased, whilst the number of trades in the Banking Sector came 2nd. When Plantations witnessed 1845 transactions, with 75.5M in T/O, Banking gave 444.40 in T/O with 1133 trades. As the ASI brought in 922M of T/O, what contributed by Banks was about 48%. Manufacturing with 1191 trades became the 3rd heavily traded sector, but it was the 2nd highest Sector in terms of T/O with 247.1M.

MHDL was the highest traded counter, and along with this LDEV witnessing 232 trades dominated Land and Property Sector. However LDEV manages Agarapathana Plantations, hence it is more like a company that needs to be monitored with the Plantations than with L&P sector.

Sampath and Commercial Banks saw a lot of participation primarily by foreign and local investors, along side some local traders. Sampath saw a T/O 149.5M, in the normal board, whilst 154.5M came in from a Crossing. Sampath saw a high of 327, and Comb saw a high of 147.90.

Retailers kept mopping up Plantations with ELPL being the top trader, as MAL saw 341 trades. BALA came out of the accumulation to break out of 39. LDEV too witnessed mopping up yet it is trading below the present high of 12.80.

Tokyo saw a crossing of over 2M shares, perhaps the last stages of the Foreign selling. Need to keep an eye on this.

As mentioned yesterday I prefer to track the weekly ASI chart, and the key area to test is 6650. As the ASI closed at 6529 today it is about 130 points above. The 200 DMA looks a support at present which is around 6397 points.

The activity levels of the Plantation Sector increased, whilst the number of trades in the Banking Sector came 2nd. When Plantations witnessed 1845 transactions, with 75.5M in T/O, Banking gave 444.40 in T/O with 1133 trades. As the ASI brought in 922M of T/O, what contributed by Banks was about 48%. Manufacturing with 1191 trades became the 3rd heavily traded sector, but it was the 2nd highest Sector in terms of T/O with 247.1M.

MHDL was the highest traded counter, and along with this LDEV witnessing 232 trades dominated Land and Property Sector. However LDEV manages Agarapathana Plantations, hence it is more like a company that needs to be monitored with the Plantations than with L&P sector.

Sampath and Commercial Banks saw a lot of participation primarily by foreign and local investors, along side some local traders. Sampath saw a T/O 149.5M, in the normal board, whilst 154.5M came in from a Crossing. Sampath saw a high of 327, and Comb saw a high of 147.90.

Retailers kept mopping up Plantations with ELPL being the top trader, as MAL saw 341 trades. BALA came out of the accumulation to break out of 39. LDEV too witnessed mopping up yet it is trading below the present high of 12.80.

Tokyo saw a crossing of over 2M shares, perhaps the last stages of the Foreign selling. Need to keep an eye on this.

As mentioned yesterday I prefer to track the weekly ASI chart, and the key area to test is 6650. As the ASI closed at 6529 today it is about 130 points above. The 200 DMA looks a support at present which is around 6397 points.

Wednesday, October 4, 2017

ASI Today - 04.10.2017, weekly chart is looking great. Can expect a 100 point rise!!!

Today's Market was not that friendly for all retailers. Yet it offered opportunities for those who act with patience and plan. The T/O was huge, and totalled 2.44B.

As I've been commenting, (well it is not only me but many would agree), that those heavily traded stocks which had brought Retailers and Large traders to the Market has to Consolidate. They must be given some amount of breathing space to accumulate and get those impatient, directionless traders to exit, and sell, in the process allow those who see the potential of those counters to collect and wait for the next move. The noticeable feature is that this side way movement is not at all corrective, that is because the tiny pauses the stocks go into are treated as quick collections to be grabbed by many, thanks to the expected Profit growths in these counters.

As noticed the amount of transactions dropped in the ASI, after hitting an unbelievable number of 10204 trades on the 2nd instant, it fell to 7220 in today's trades. This gives all Retailers that nothing goes up in one line nor vise versa. You must be geared and prepared for the worse case. UNLESS YOU KNOW TO MANAGE YOUR RISK you will be lost, and your trading will make you a loser. I suggest you to trade in small volumes and kick your GREED off.

When the Plantations and few other actively traded stocks went in a slow pace, the BANKS and a few S&P SL 20 counters dashed in with a vengeance. Commercial Bank Voting can never be traded by those short term traders. If that had to be taken up to it's rightful place, the Big Investors and Traders should get into action. That's what happened today. There were 3 major trades in COMB, 10 M @ 145, whilst 2.36M in 2 blocks went @ 146/=. All were bought by Foreigners. The next major trade was in HNB, with 102K traded @ 245.50. In the Normal Board there were 326 transactions in COMB between 140.50 and 146.50, while closing @ 146.00. All though HNB was not in the top 25 heavily traded list it had 50 trades between 245 and 246.10, finally closing @ 246.00. JKH is trending at the higher end of the channel, between 160 and 165, closed @ 164/=. The major mind blower still is SAMP - with 165 trades and T/O of 27M, it traded between 320/= and 325/50.

As sectors we saw 1941 trades in the Banking sector chipping with a whopping T/O of 2.14B taking the BFI index up by 235 points, whilst the near 2nd was the Traders darling - Plantation Sector. It saw 1648 trades with 63M in T/O, but it dropped marginally by 8.04 points. Manufacturing was the 3rd highest traded with 954 trades, but dropping by 16.48 points. The 4th being Land & Property Sector where we saw 712 trades with the index being unchanged.

I expect Friday's trading to be somewhat lacklustre as it is a day between 3 holidays and being the last day of the week, but could be an occasion to go shopping if the retail stocks continue to retrace. Yet the bulls wont just give lightly on Banks and plantations.

WEEKLY ASI CHART - 100 points rise could be on the cards........ have a look at the chart.

As I've been commenting, (well it is not only me but many would agree), that those heavily traded stocks which had brought Retailers and Large traders to the Market has to Consolidate. They must be given some amount of breathing space to accumulate and get those impatient, directionless traders to exit, and sell, in the process allow those who see the potential of those counters to collect and wait for the next move. The noticeable feature is that this side way movement is not at all corrective, that is because the tiny pauses the stocks go into are treated as quick collections to be grabbed by many, thanks to the expected Profit growths in these counters.

As noticed the amount of transactions dropped in the ASI, after hitting an unbelievable number of 10204 trades on the 2nd instant, it fell to 7220 in today's trades. This gives all Retailers that nothing goes up in one line nor vise versa. You must be geared and prepared for the worse case. UNLESS YOU KNOW TO MANAGE YOUR RISK you will be lost, and your trading will make you a loser. I suggest you to trade in small volumes and kick your GREED off.

When the Plantations and few other actively traded stocks went in a slow pace, the BANKS and a few S&P SL 20 counters dashed in with a vengeance. Commercial Bank Voting can never be traded by those short term traders. If that had to be taken up to it's rightful place, the Big Investors and Traders should get into action. That's what happened today. There were 3 major trades in COMB, 10 M @ 145, whilst 2.36M in 2 blocks went @ 146/=. All were bought by Foreigners. The next major trade was in HNB, with 102K traded @ 245.50. In the Normal Board there were 326 transactions in COMB between 140.50 and 146.50, while closing @ 146.00. All though HNB was not in the top 25 heavily traded list it had 50 trades between 245 and 246.10, finally closing @ 246.00. JKH is trending at the higher end of the channel, between 160 and 165, closed @ 164/=. The major mind blower still is SAMP - with 165 trades and T/O of 27M, it traded between 320/= and 325/50.

As sectors we saw 1941 trades in the Banking sector chipping with a whopping T/O of 2.14B taking the BFI index up by 235 points, whilst the near 2nd was the Traders darling - Plantation Sector. It saw 1648 trades with 63M in T/O, but it dropped marginally by 8.04 points. Manufacturing was the 3rd highest traded with 954 trades, but dropping by 16.48 points. The 4th being Land & Property Sector where we saw 712 trades with the index being unchanged.

I expect Friday's trading to be somewhat lacklustre as it is a day between 3 holidays and being the last day of the week, but could be an occasion to go shopping if the retail stocks continue to retrace. Yet the bulls wont just give lightly on Banks and plantations.

WEEKLY ASI CHART - 100 points rise could be on the cards........ have a look at the chart.

Tuesday, October 3, 2017

BALA - Must consolidate to hit 40 and beyond

BALA - In 2012 there was a strong resistance area between 33 and 38, whilst it hit higher to test 44 as well. We could expect a consolidation in this area before the next trend continuation. As the expected fundamentals are strong we can not expect the bullish expectations to exacerbate just yet.

You need to accumulate on weakness, as this counter is certainly not done yet.

You need to accumulate on weakness, as this counter is certainly not done yet.

ASI Today - 03.10.2017

ASI - If yesterday was the day of the Retailers domain, today the game changed towards the Big guns. Turnover was relatively considerable, as it exceeded 1 billion to register at LKR 1,345,283,456. Momentum is turning out to be more towards a trend continuation in the overall market. But the trend witnessed in the retail savvy counters checked in for some breathing space vis a vis a consolidation. But too early to say it is corrective in nature. We need to give it time, perhaps 2 or 3 days.

Mostly Traded stocks were:

One Stock that took my breath away was Sampath Bank. It screamed through to 320.10, finally to close at 320.00. This stock is trending up while there is a rights issue @ 245/00. As such need to keep our ears to the ground until it goes XR, and the Rights hit the market for trading.

Mostly Traded stocks were:

| Symbol | Share Volume | Trade volume | Change (Rs.) | Change Percentage (%) |

| ELPL.N0000 | 5,172,415 | 1,120 | 2 | 6.62 |

| LCEM.N0000 | 3,605,998 | 624 | -0.3 | -3.75 |

| MAL.N0000 | 2,009,025 | 522 | 0.2 | 1.63 |

| LDEV.N0000 | 1,844,672 | 478 | 0 | 0 |

| BALA.N0000 | 666,707 | 468 | 0 | 0 |

| ACME.N0000 | 1,843,729 | 395 | 0.2 | 3.17 |

Whilst the stocks that came out of their consolidations were:

| Symbol | Share Volume | Trade volume | Change (Rs.) | Change Percentage (%) |

| COMB.N0000 | 309,464 | 175 | 2.2 | 1.59 |

| JKH.N0000 | 492,394 | 83 | 1 | 0.61 |

| CFVF.N0000 | 186,404 | 112 | 1.5 | 4.34 |

One Stock that took my breath away was Sampath Bank. It screamed through to 320.10, finally to close at 320.00. This stock is trending up while there is a rights issue @ 245/00. As such need to keep our ears to the ground until it goes XR, and the Rights hit the market for trading.

TKYO, JKH and NEST had Crossing Trades totaling over 476 million.

Trend continuation is now in place and the resistance between 6500 and 6600 is the area the index needs to pierce through. Hope it will happen and head higher.

Monday, October 2, 2017

Plantations Index

PLT - Plantations moved into a long rally since late March of this year. It closed yesterday at 1083 area. Whilst the fib extension of the 1st uptrend from Late March to late May, suggests that the 161.8% completion takes place around 1097 points. But the momentum of the counters in the sector is not showing considerable retracements mainly due to the strong growth expectations in this sector, after many torrid and dismal years. However the time is not right to invest into these counters but has a lot of steam for traders. So they should sieze the opportunity and enjoy the ride by keeping strict money management techniques.

ASI Today - 02.10.2017

ASI - Closed 32 points ahead of the previous close at 6470.96 points. Turnover was 549.47M, lower than previous. But the transactions exceeded 10,204 that was stupendous, given the Turnover levels. This clearly showed the level of interest by Retailers in action. As such the Market was highly concentrated on the Plantation Stocks, coupled with a few trading stocks.

Heavily Traded Stocks were:

Lanka Cement - 866 trades. T/O 33M, +1/50(22.73%)

Lankem Development - 784 Trades. T/O 35.4M, +1/10(10%)

Balangoda Plantations - 768 Trades. T/O 37.1M, +6.10(20%)

Malwatte Valley Plantations - 757 Trades. T/O 41.7M, +1.80(17.1%)

Malwatte Valley Plantations (Non Voting) - 657 Trades. T/O 20.6M, +1.90(18.63%)

Apart from the top 5 above Madulsima Plantations, ACME, Maskeliya Plantations and Lanka Orix Finance captured the Traders attention. Acme, LOFC and LCEM came in as new entrants to a much dominated Plantations counterparts.

However it was the S&P SL 20 heavy weights that took the ASI up. The major contributors were:

Ceylon Tobacco - 20 Trades. T/O 19.07M, +29/-(2.99%)

Cargills - 41 Trades. T/O 3.6M, +8.10(4.22%)

LOLC - 86 Trades. T/O 39.4M, +5/-(3.94%)

HNB - 23 Trades. T/O 13.4M, +5/-(2.13%)

Sampath - 72 Trades. T/O 22.8M, +1/50(.49%)

JKH - 49 Trades. T/O 13.7M, +1/50(.92%)

The movements we saw in the blue chips are encouraging, and we can expect a positive momentum for tomorrow as well.

There are day trading opportunities, but one must never trade without money management strategies.

There was one solitary LION trade that was over 20M(Crossing) chipping in 24M.

Heavily Traded Stocks were:

Lanka Cement - 866 trades. T/O 33M, +1/50(22.73%)

Lankem Development - 784 Trades. T/O 35.4M, +1/10(10%)

Balangoda Plantations - 768 Trades. T/O 37.1M, +6.10(20%)

Malwatte Valley Plantations - 757 Trades. T/O 41.7M, +1.80(17.1%)

Malwatte Valley Plantations (Non Voting) - 657 Trades. T/O 20.6M, +1.90(18.63%)

Apart from the top 5 above Madulsima Plantations, ACME, Maskeliya Plantations and Lanka Orix Finance captured the Traders attention. Acme, LOFC and LCEM came in as new entrants to a much dominated Plantations counterparts.

However it was the S&P SL 20 heavy weights that took the ASI up. The major contributors were:

Ceylon Tobacco - 20 Trades. T/O 19.07M, +29/-(2.99%)

Cargills - 41 Trades. T/O 3.6M, +8.10(4.22%)

LOLC - 86 Trades. T/O 39.4M, +5/-(3.94%)

HNB - 23 Trades. T/O 13.4M, +5/-(2.13%)

Sampath - 72 Trades. T/O 22.8M, +1/50(.49%)

JKH - 49 Trades. T/O 13.7M, +1/50(.92%)

The movements we saw in the blue chips are encouraging, and we can expect a positive momentum for tomorrow as well.

There are day trading opportunities, but one must never trade without money management strategies.

There was one solitary LION trade that was over 20M(Crossing) chipping in 24M.

Sunday, October 1, 2017

BFI - Banks, Finance and Insurance Index is ahead of the ASI

The All time high of the All Share Index was in Feb of 2011 @ 7825 points, but the Banking,Finance and Insurance sector index known as BFI has broken out of it's 2011 highs and hit the all time high in August of 2015. Therefore it is clear that this Sector is trading ahead of the ASI.

But as we know this sector as well as the Economy of the country is going through a lot of re-positioning, hence a lengthy consolidation can be seen in the price action of the index above 14000 points, with a strong support at 16000 which was an important support between 2010 and 2011 period. This will re-test it's all time high of 19913 points eventually with a short term resistance at 17627 points. At present it is above the support at 16000 as it closed at 16610 points on Friday the 29th ultimo.

But as we know this sector as well as the Economy of the country is going through a lot of re-positioning, hence a lengthy consolidation can be seen in the price action of the index above 14000 points, with a strong support at 16000 which was an important support between 2010 and 2011 period. This will re-test it's all time high of 19913 points eventually with a short term resistance at 17627 points. At present it is above the support at 16000 as it closed at 16610 points on Friday the 29th ultimo.

Friday, September 29, 2017

ASI today - 29.09.2017

ASI - Closed at 6442.71, that's a slight improvement of 9.17 points(.14%) over yesterday. Turnover was Rs. 782,344,640.00 below yesterday's value of Rs. 801,015,189. However the number of transactions were higher recording at 7967 trades against 5,849 recorded yesterday. Amongst the S&P SL 20 Stocks the LONE PERFORMER was SAMPATH BANK PLC (LKR 310/=) with 124 transactions, and a turnover of Rs. 42,086,596.10, gaining 5.50 over yesterday's close.

The heavily traded shares were all retail favorites such as Lankem Developments Plc (663 Trades, +1/10. 11%), Malwatte valley Plantations Plc - Non Voting (637 Trades, +1/60, 18%), Lanka Cement Plc (611 Trades, +1/10, 20%), Malwatte Valley Plantation Plc (566 Trades, +1/20,12.9%) and Richard Peiris and Company Plc (258 Trades, +-/50, 3.82%).

Crossings (Block trades over LKR 20 mill) were witnessed on HNB (LKR 20,938,500/=), LION (LKR 110,081,250/=), and COMB ( LKR 65,561,160/=).

Going forward to the next week, which will be the beginning of October expectations are for the retail momentum to continue. As the latter part of October starts the earnings of the 3rd Quarter, counters that are tipped to have performed well would draw a lot of volatile market activities.

The heavily traded shares were all retail favorites such as Lankem Developments Plc (663 Trades, +1/10. 11%), Malwatte valley Plantations Plc - Non Voting (637 Trades, +1/60, 18%), Lanka Cement Plc (611 Trades, +1/10, 20%), Malwatte Valley Plantation Plc (566 Trades, +1/20,12.9%) and Richard Peiris and Company Plc (258 Trades, +-/50, 3.82%).

Crossings (Block trades over LKR 20 mill) were witnessed on HNB (LKR 20,938,500/=), LION (LKR 110,081,250/=), and COMB ( LKR 65,561,160/=).

Going forward to the next week, which will be the beginning of October expectations are for the retail momentum to continue. As the latter part of October starts the earnings of the 3rd Quarter, counters that are tipped to have performed well would draw a lot of volatile market activities.

Wednesday, September 27, 2017

COMB - Accumulation persists

COMB - The other heavy weight in the bourse is trending, thereby allowing the long term players to just pluck the fruits liberally. No trader would like what's going on here. As long as the counter is holding above 135, the momentum can be bullish.

JKH - Trending

JKH - The leading stock in the market is trending between 160 and 165. As long as it hold within this channel, expectations of an uptrend shouldn't be a problem. Yet it is somewhat frustrating, but that's how things are....

As can be seen the counter tried to break out of 165, and retraced, I do not want to lose hope of that indication of expecting a trend continuation.

Presently it is the Investors who are collecting as it appears, let's hope that the traders too will get an opportunity.

As can be seen the counter tried to break out of 165, and retraced, I do not want to lose hope of that indication of expecting a trend continuation.

Presently it is the Investors who are collecting as it appears, let's hope that the traders too will get an opportunity.

BIL - Wish it could hit higher

BIL - Rallied within 18 weeks from 1.20 to 3.50, a whopping 192%. Now it's history, but what happened then has not send the traders away from it just yet. The retracement brought it down to 2.90, exactly 23.6% on the fib retracement line. That is something to watch. Retracements tend to be longer than that, but if the trend is going to be in agreement with both the buyers and sellers, then this pause will be over and trend up to test 3.80 and 4.00. If that happens in a matter of days or weeks, it could be a decent return. I suggest to collect between 2.90 and 3.40, and, as it is now at 3.30 - 3.40 why not try some at that, and target 3.80 to 4.00 which could give you about a 14% return. But what I wonder is that the position traders who are accumulating big numbers would settle for as small a % as 14%.

Tuesday, September 26, 2017

RICH - Start Collecting

RICH - The rapid move from 9.80 to 13.40 within 6 days, made the trend to go into a cooling out retracement. This was a good and healthy development for it's trend continuation.

Time has now come to collect within a channel which I classify as the present support base between 11.40 to 12.00. Suggest a collection within this range. Thereafter I expect a rally to breakout of 13.40 and test newer highs upto 14.00 - 15.00. BUT THIS WILL HAPPEN WHEN DAILY VOLUMES ARE HIGHER THAN 1 MILLION SHARES. Presently it's trading with very thin volumes.

You must not over expose when you are collecting a position on this. If you think to buy 10,000 buy only 20% or 10% maximum. This way you are giving yourself room of either 5 or 10 stages at which you will collect the full number. If you see it's breaking out of 12.00 and you have not completed the collection of a fair number, that's ok, stick to the amount you bought and wait for your target. Target can be between 12.50 and 15.00. As such the exit strategy can be decided by you.

Do not ignore this opportunity......

Time has now come to collect within a channel which I classify as the present support base between 11.40 to 12.00. Suggest a collection within this range. Thereafter I expect a rally to breakout of 13.40 and test newer highs upto 14.00 - 15.00. BUT THIS WILL HAPPEN WHEN DAILY VOLUMES ARE HIGHER THAN 1 MILLION SHARES. Presently it's trading with very thin volumes.

You must not over expose when you are collecting a position on this. If you think to buy 10,000 buy only 20% or 10% maximum. This way you are giving yourself room of either 5 or 10 stages at which you will collect the full number. If you see it's breaking out of 12.00 and you have not completed the collection of a fair number, that's ok, stick to the amount you bought and wait for your target. Target can be between 12.50 and 15.00. As such the exit strategy can be decided by you.

Do not ignore this opportunity......

Wednesday, September 20, 2017

Update!!! Plantations - Keep an eye, to collect again

26.09.2017 - Update

Trend only took a breather but not a retracement. Once again the closing is almost at the exact recent high and 100% fib extension of 1023 points. I am closely watching the reversal, let's see how it'll work. However some followed my suggestion of collecting during this breather. Which paid off.

PLT - became the favourite of the retailers since april of this year. There was a retracement in late june making a swing low. There after it rallied again to complete a 1 time trend extension on the 18th of September. This sector will now move into a retracement or have moved into a retracement already. This will bring it back to a range between 900 and 950 points, and expect a trend continuation to test 1020 to 1100 points. Watch and pick your favourite stock in this sector little by little for another move up.

Trend only took a breather but not a retracement. Once again the closing is almost at the exact recent high and 100% fib extension of 1023 points. I am closely watching the reversal, let's see how it'll work. However some followed my suggestion of collecting during this breather. Which paid off.

PLT - became the favourite of the retailers since april of this year. There was a retracement in late june making a swing low. There after it rallied again to complete a 1 time trend extension on the 18th of September. This sector will now move into a retracement or have moved into a retracement already. This will bring it back to a range between 900 and 950 points, and expect a trend continuation to test 1020 to 1100 points. Watch and pick your favourite stock in this sector little by little for another move up.

Tuesday, September 19, 2017

KAPI - need to break out of 32.50

KAPI - Trend is fragile due to the dismal performance in the June quarter. As such the market will watch their profits. The present spike in trading should take it up above 32.50 and form a very strong support within 30-32.50 channel. else it could find support at the Mar 2016 low of 28.00.

Let's watch how strong the support is gonna be. Short term trade is evident between a buy at 31 to 31.50 for a sell above 33.00. A stop should be maintained at 30.00.

Let's watch how strong the support is gonna be. Short term trade is evident between a buy at 31 to 31.50 for a sell above 33.00. A stop should be maintained at 30.00.

Monday, September 18, 2017

Watch for these Trades!!!

Get into action on the following Stocks:

CFVF - Collect between 34.50 and 35.50. Support is evident at 33.50. Expect 39/40 to 41.00. Volumes above 100k is a strong trigger for the Rally.

RICH - Collect between 11/00 and 11/50. Will test the recent high of 13.40, and a rally will take it upto 15.00 based on fib extensions.

BALA - Trend reversal would lead to a minor correction. Collect between 26.50 and 27.50.

JKH - If a strong base is formed between 160(support) and 165(Resistance) it will be very bullish for the stock.

DOCK - Collect between 100 and 102. A rally will take it upto 110.50.

CFVF - Collect between 34.50 and 35.50. Support is evident at 33.50. Expect 39/40 to 41.00. Volumes above 100k is a strong trigger for the Rally.

RICH - Collect between 11/00 and 11/50. Will test the recent high of 13.40, and a rally will take it upto 15.00 based on fib extensions.

BALA - Trend reversal would lead to a minor correction. Collect between 26.50 and 27.50.

JKH - If a strong base is formed between 160(support) and 165(Resistance) it will be very bullish for the stock.

DOCK - Collect between 100 and 102. A rally will take it upto 110.50.

Saturday, September 16, 2017

TAFL - 115 -128 Major support

TAFL - Stock to watch. There is a major support between 115 and 128. Once broken will test 131.50.This is a stock that moves rapidly once a trend is set. Also we should not ignore the huge price range it trades intra-day as well. That is because of the illiquid nature of the stock. If you keep a careful watch on this, there are plenty of day trades or regular short term trades if you patiently collect at the lower base of the said support area. 117.50 is the present swing low, as such try and place orders around 117.50 and 121.00 in order to reap the benefits of the huge price range movements.

Thursday, September 14, 2017

ASI - Uncertain path persists

There are no firm indications for the ASI to be very bullish. However the present position of the ASI is more relieving for the bulls, but need to tread with caution.

Progress it had made in the weekly chart reveals a small up tick on the RSI, which needs to be watched.

Progress it had made in the weekly chart reveals a small up tick on the RSI, which needs to be watched.

Subscribe to:

Posts (Atom)

Loss and Gain of the ASI in 2021 vs the Loss in 2022

This ASI chart shows the All time high in 2021 of 9025.82 on the 29th 0f Jan'21 and the fall to the yearly low of 6852.64 on the 19th ...

-

Dr. Michael Burry is the ONE EYED Physician turned Fund Manager, who figured out that the Housing Market in the US is going to fall apart,...

-

RCA STRATEGY The challenge of covering updates of this Strategy of Stock Accumulation was daunting. But when you stick to the Rules a...

-

Amidst haemorrhage in this counter there was a reversal to the up. But that doesn't mean every thing is well. However it's worth ...